Defective Ownership

I got an interesting text from my brother this week. He’s a Mercedes Benz Elite Technician at a dealership that will remain anonymous for now. He was working on a fairly new SL550’s Magic Sky Roof. What is a Magic Sky Roof you ask? Badass, that’s what is is. Imagine a glass roof that goes from opaque to crystal clear with the flip of a switch. Back in my Mercedes salesman days, the "Panorama Roof" option on an SL got you a glass panel with a rinkee dink, perforated shade that didn’t do that much shading. Oh, and you had to use your hand to slide it open and closed. My, how the times have changed. For a modest $2,500 you can have a glass roof that switches between clear and opaque at the push of a button.

From mostly opaque and mostly clear at the push of a button. It's a box on the option sheet I would probably check if I had SL money at my disposal. Photo Credit: Motor Trend

That is, until you forget that you left something on the roof and put the roof down. Crunch. The cost to replace a damaged Magic Sky roof? In this case, my brother claims about $12,500. Ouch.

In what seemed like the same day, a co-worker came to me asking what to do about their 2023 Jeep Wrangler’s cracked turn signal lens. “This is covered under warranty, right?”, she asked. She was afraid to know how much it would cost to get one. For a second, so was I. This Jeep lives on Nantucket, a small island about 40 miles off the coast of the United States. An island where millionaires complain about jet fuel shortages and are too lazy to pick up the $100 bill they accidentally drop. Luckily for my co-worker, I have a wholesale parts account at a Jeep dealership on the main land, her base model Jeep doesn’t have expensive LED lights, and she has a handy friend to install it. Her run in with a mailbox only set her back $65. Phew. It looks like she’ll be able to make it to her second job that pays for her subsidized housing without getting a ticket. In a zip code where the “average” house will cost you $2.5 million, us normal people need to save every dime we can.

New vehicle warranties only cover defects in workmanship and materials. Not defects in the care of the vehicle. At least that’s the jist of all of the fine print in the back of the owner’s manual. You read the owner’s manual, right? When I was a service advisor, if a car was still within it’s factory warranty, people asked if literally anything they did to their car was under warranty. Being a veteran of “premium” manufacturers, I always thought this was a product of people buying more car than they afford to maintain. After surfing the private Facebook groups for dealership employees, I’ve learned this happens at every dealership and every price point.

I’ll be the first to admit that my soul went cold and dark many years ago. After nearly two decades in the car business your emotions towards cars and their owners goes numb. However, a microscopic part of me can sympathize with people looking for a manufacturer to pick up the tab on an issue that is clearly the owner’s fault. Despite a recent dip, Motor Trend claims the average transaction cost of vehicles has been on the rise for years. So if you’re shopping, plan on spending $48,000 on average. As a result, the average length of an auto loan has increased significantly. According to credit karma the old standard 36 or 48 month loan has increased to an average of 70 months. All in an effort to keep monthly payments manageable. This leaves the consumer paying more money in interest and losing more money to depreciation than ever before. With so much on the line financially, it’s only natural for a customer to want everything they paid for. And then some!

Sprinkling the other financial oddities of today on top like high inflation and wage stagnation makes for a terrible economic ice cream sundae. As cars have been improved over the decades, prices have shot up. Safety features like air bags, tire pressure monitoring systems, and back-up cameras that are mandated by the government are not free extras. Consumers are footing the bill for these features, despite their undeniable benefits.

The attitude of bigger, faster, and better combined with those government mandated safety features and economic stressors are pushing consumers to their economic limit. If you’re in the market for a car, new or used, you have to be savvier than usual in order to get a good deal. The manufacturer and your dealership aren’t going to save your financial day when you’re at fault for damage to your vehicle, no matter how much you paid for it. So budget accordingly!

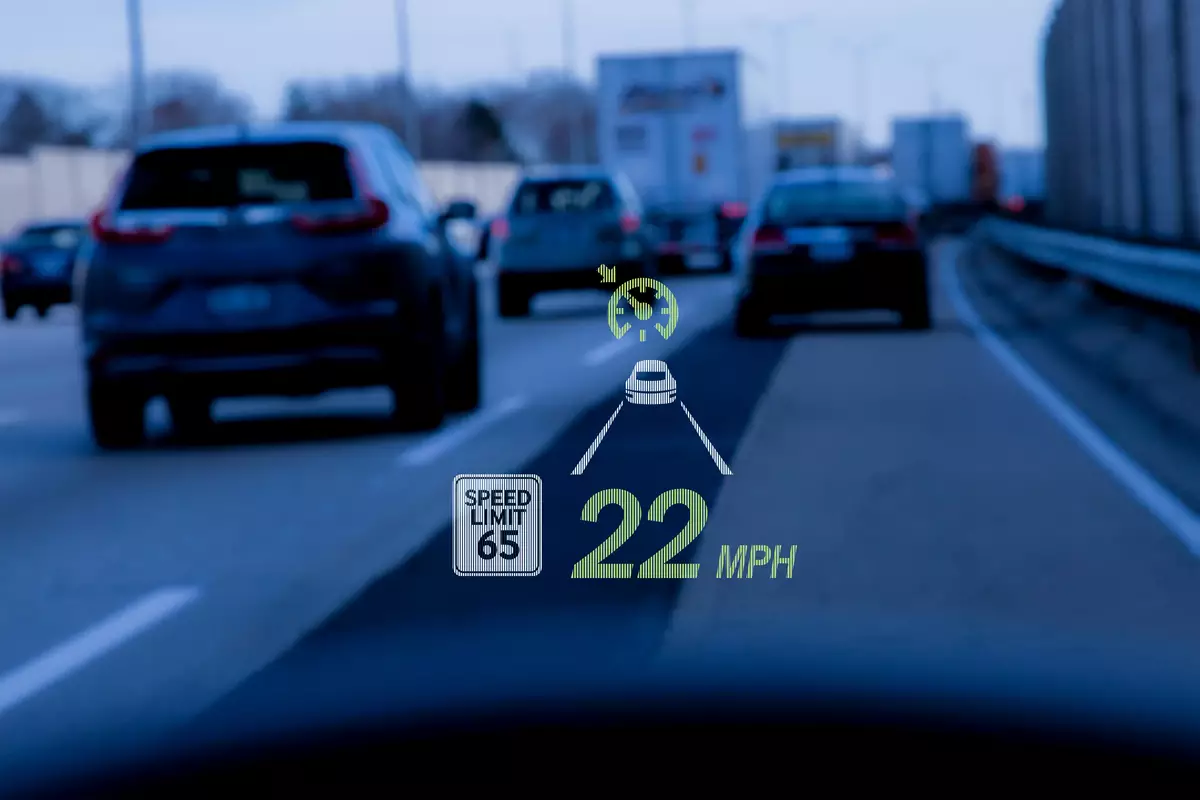

Run flat tires are expensive to replace and usually cannot be patched. Windshield wipers don’t cost $10 anymore; some are proprietary and can only be purchased from dealerships. If you have a head up display, be sure to have glass coverage on your car! Replacement windshields for vehicles with a head up display are offensively expensive and not all states require auto insurance companies to cover windshield damage. I’ve seen all of these issues come across my desk as a service advisor, and more!

Head up displays need special windshields and windshield wipers are fancier than ever. Photo Credit: Cars.com and Mercedes-Benz

So what is the take away here? Cars are more expensive than ever and there is a good chance you’ll wind up paying more in interest and depreciation than in the past. Don’t just research what the two or three you’re interested in costs to buy, aggressively research how much it will cost to maintain. When in doubt, buy “less” car and pocket the rest for a rainy day. One will come sooner or later, trust me.

It’s not all doom and gloom though! Despite the cost of vehicles going up with no end in sight, they’re lasting longer than they ever have before. There’s a better chance than ever that your big purchase will be getting you from point A to point B longer than you think. Hopefully this eases any pain from an expensive “oopsies” you have along the way.

Comments ()