Sullivan Tire Shenanigans

This is a business move disguised as altruism. It's an opportunity for Sullivan to shed debts they've racked up while allowing the Sullivans to cash in.

Unless you’ve been living under a rock this week, you’ve read the two paragraph press release being retweeted by news outlet all over the New England region.

“Massachusetts-based Sullivan Tire turns company ownership over to employees.”

Pardon my eye roll…But before we go too far, its time for some context.

After 68 years in the most cut-throat sector of the automotive business, Sullivan Tire is “giving” itself to it’s nearly 1,500 employees. Through an Employee Stock Ownership Program, also known as an ESOP, Sullivan Tire will give shares of the company to its employees. The shares will be fully vested after 6 years. These shares can be redeemed at retirement or rolled into a retirement plan should an employee leave the company before they retire. Employees will earn more stock based upon their time with the company and their performance over the next several decades.

Paul Sullivan, vice-chairman of Sullivan’s board of directors, told WBZ-TV “there’s no trickery to this. It’s more important for us to keep the culture.”

Despite what the headlines lead you to believe, this is not what employee empowerment looks like at all. It’s a bridge too far to accuse the Sullivans of anything malicious, but they'll be getting more out of this deal than their employees. Trust me. The free marketing Sullivan Tire has received from this alone is priceless. Certainly worth more than an ad campaign featuring a Boston sports hero or cute kid in the snow, two of Sullivan Tire’s favorite things to shell out money on. In many ways this is the opposite of employee empowerment, it’s an employee manipulation tactic.

How so? It comes down to the nature of an Employee Stock Ownership Program. How much is one share of Sullivan Tire worth? Only Sullivan Tire can tell you how much it’s worth...when it comes time to retire or quit. These shares are not traded publicly and are only worth anything to Sullivan Tire when an employee exits the company. When an employee leaves, they will be given a lump sum payment for their stock. With some old fashioned hard work from employees, the value of the stock is continually appreciating. Maybe with some extra hard work, employees will earn an extra share next year instead of that raise!

You know what’s falling out of style these days? Devaluing your employees while simultaneously preaching that you’re a family, team, unit, or whatever. In a world where employee loyalty is at an all-time low, this is a move to keep employees in line and encourage them to not seek out better job opportunities. While the headlines imply much more, Sullivan’s 1,500 employees will likely never hold a majority stake in the company. If the Sullivan Brothers wanted to slash wages, stay open until midnight, or even close locations, employees cannot veto them. Why? Because this is not a lock, stock, and barrel sale. Upper management, consisting of the Sullivan Brothers, is staying put. Employee owned shares of Sullivan stock are only a carrot on a stick here. If you just work a little harder, take a home team discount on pay (you are an owner after all!), your stock will appreciate! Except a Sullivan employee…I mean “owner”…cannot sell their stake in the company unless they leave. Conversely, they cannot keep their stake if they choose to leave the company. So what does a Sullivan employee actually own? Nothing. Just an I.O.U. from Sullivan Tire for an amount of the company’s choosing.

I own stock, actual stock. Don’t get the wrong idea though. I don’t own enough to brag about, just enough to make a point. Despite being a microscopic owner, I receive post cards from the companies I own that allow me to vote on topics that come up at board meetings. Everyone does. Do you own Apple Stock and hate CEO Tim Cook? You can vote to fire him when the next round of board of directors nominations comes up. Heck, you can even try to replace him yourself if you’re so inclined. If a tire changer at Sullivan Tire tried anything close to that, they’d likely be shown the door despite being an “owner”.

Stock holders can vote one of these guys off the board of directors and not the other. Take a guess which one. Photo Credit: CBS News & Variety

So aside from all of the marketing hype and the carrot on a string tactic to employees, is there a benefit nobody is talking about here? Absolutely, it’s money. Money for the Sullivans, not the employees. For a company like Sullivan Tire, the hurdles to clear for the Sullivan Brothers to sell off a chunk of the company tax free are pretty low. It’s impossible to know all of the details of Sullivan’s deal, but according to the American Bar Association, so long as they shed 30% of the company, the Sullivan’s are getting a huge payday. Mostly, if not completely, tax free. They’ll also have an opportunity to shed large debts the company might have hanging around in the process and still run the company.

“…I think it’s a win-win for everybody.” ~Rob Legros, Sullivan Tire Employee

It's a shrewd business move disguised as employee empowerment. They’re winning exponentially more than you, Rob, sorry.

I’m not one to look a gift horse in the mouth; I wouldn’t say no to a weird 401k program advertised as “ownership” if it came my way. But I’m not afraid to ask tough questions Human Resources doesn’t have a scripted answer for so I can dig a little deeper. (Just ask my old HR manager at GPC.) People on Facebook are eating this up as an altruistic move from a company working hard for their employees. Sullivan employees are likely buying into it as well. Except this is a business move disguised as altruism. It's an opportunity for Sullivan to shed any Covid debts they've racked up while allowing the Sullivans to cash in.

Don't buy into the hype.

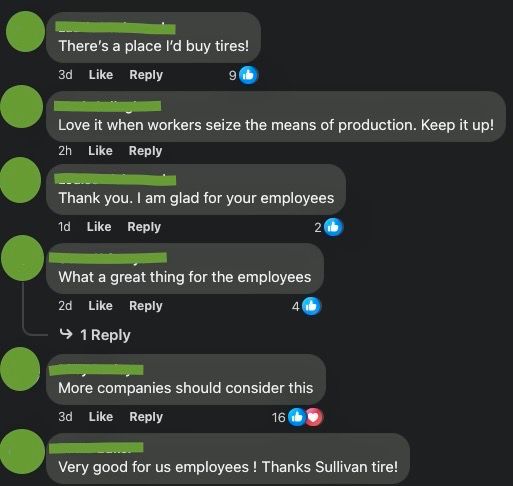

Comments ()